Find your ACA confidence

Navigate reporting and regulatory complexities with tools that bring clarity to compliance

Trusted by over 3,000 providers

Is your HR & payroll system built for healthcare?

Complexities of ACA call for an ally, let us be that ally

Compliance confidence

Know your compliance status with precision tools that work

Reporting made clear

Generate and file ACA forms accurately without the hassle

More time for what matters

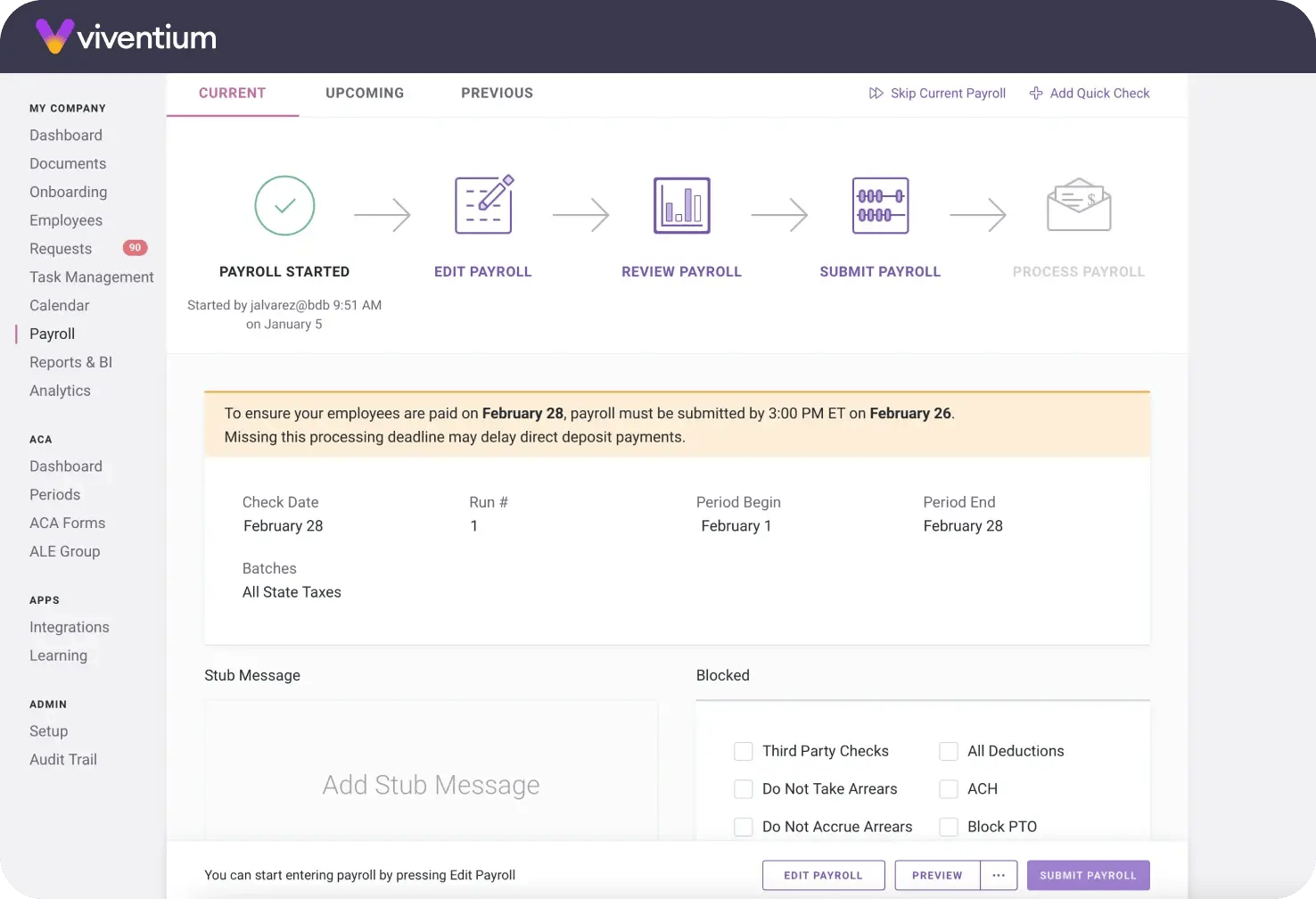

Reduce admin burden with efficient, automated workflows

Guidance that counts

Access experts who know healthcare compliance inside and out

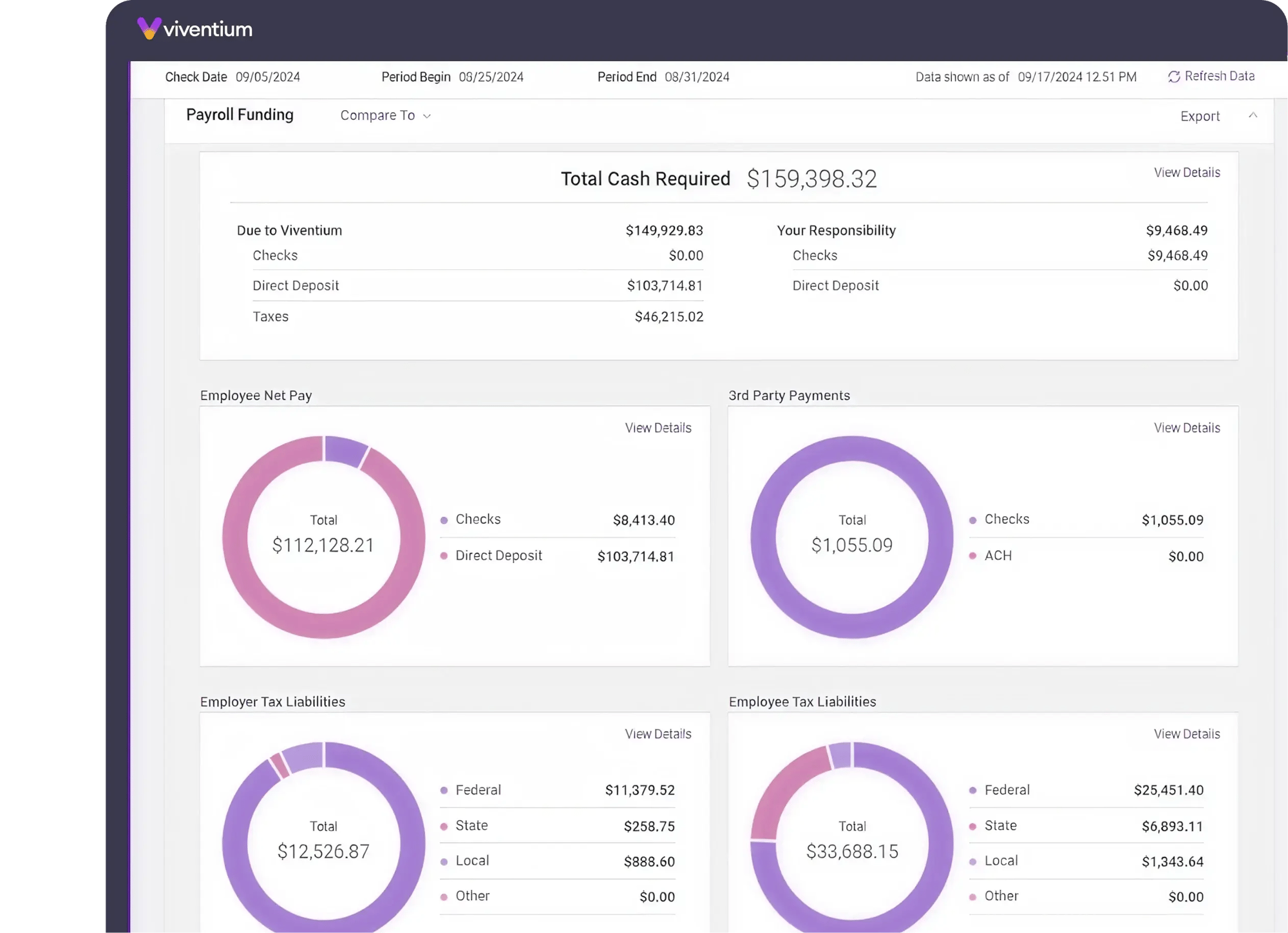

ACA tools integrated for your team

Link ACA compliance with payroll, benefits, and HR solutions in one seamless platform bringing clarity to complex requirements

Compliance without compromise

Features

Determine eligibility status

Track full and part-time status for each employee to ensure accurate ACA reporting and compliance

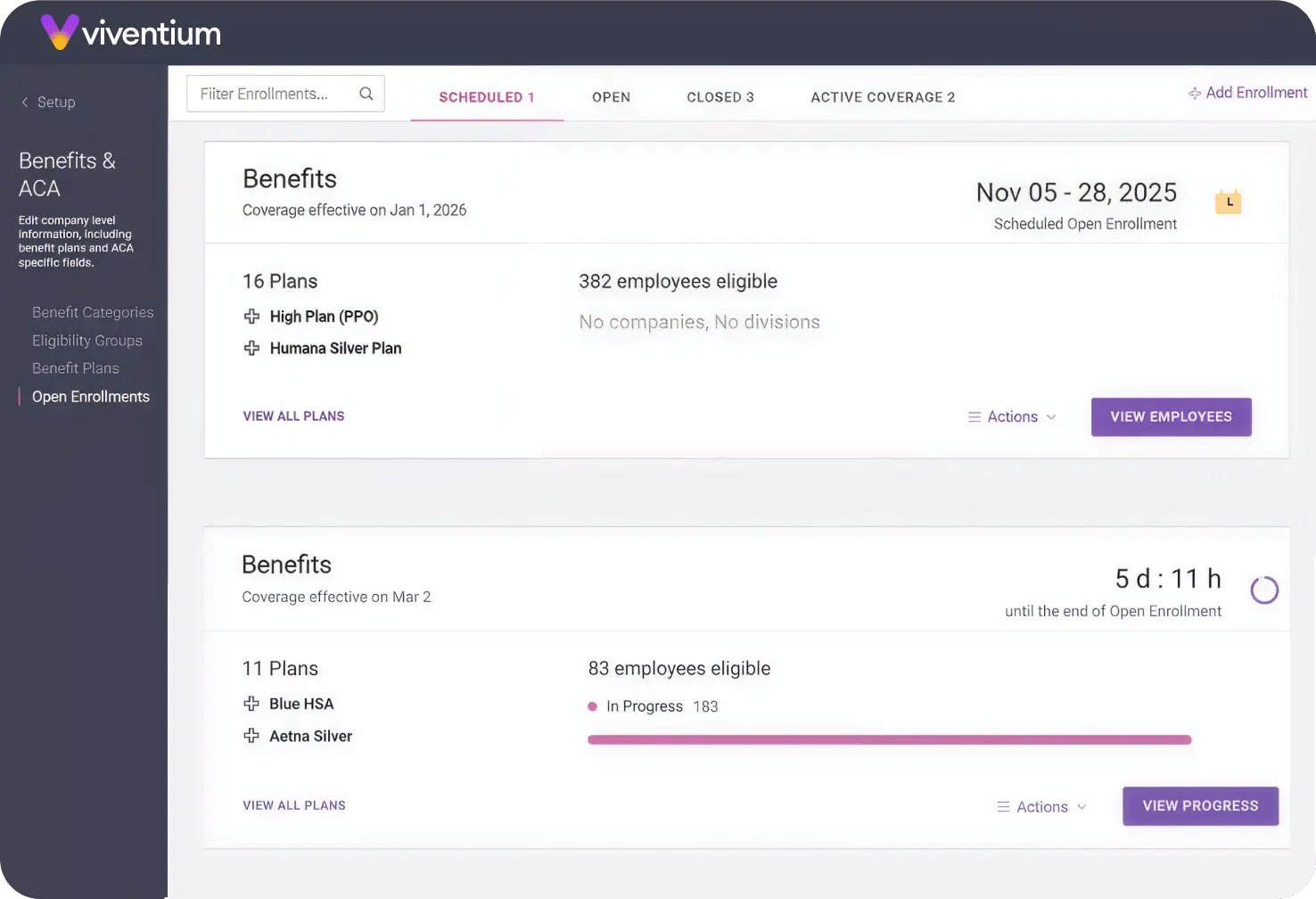

Track employee offers and enrollments

Monitor employees’ offers, enrollments, and waivers to maintain compliance

Penalty exposure alerts

Receive alerts when offers are missing or unaffordable, helping you avoid ACA penalties and stay compliant

Maintain benefit plan information

Keep benefit plan details, employee costs, and essential data to challenge proposed penalties and maintain compliance

Produce year-end ACA forms

Generate and file year-end ACA forms, including Series 1 and 2 codes, electronically with ease

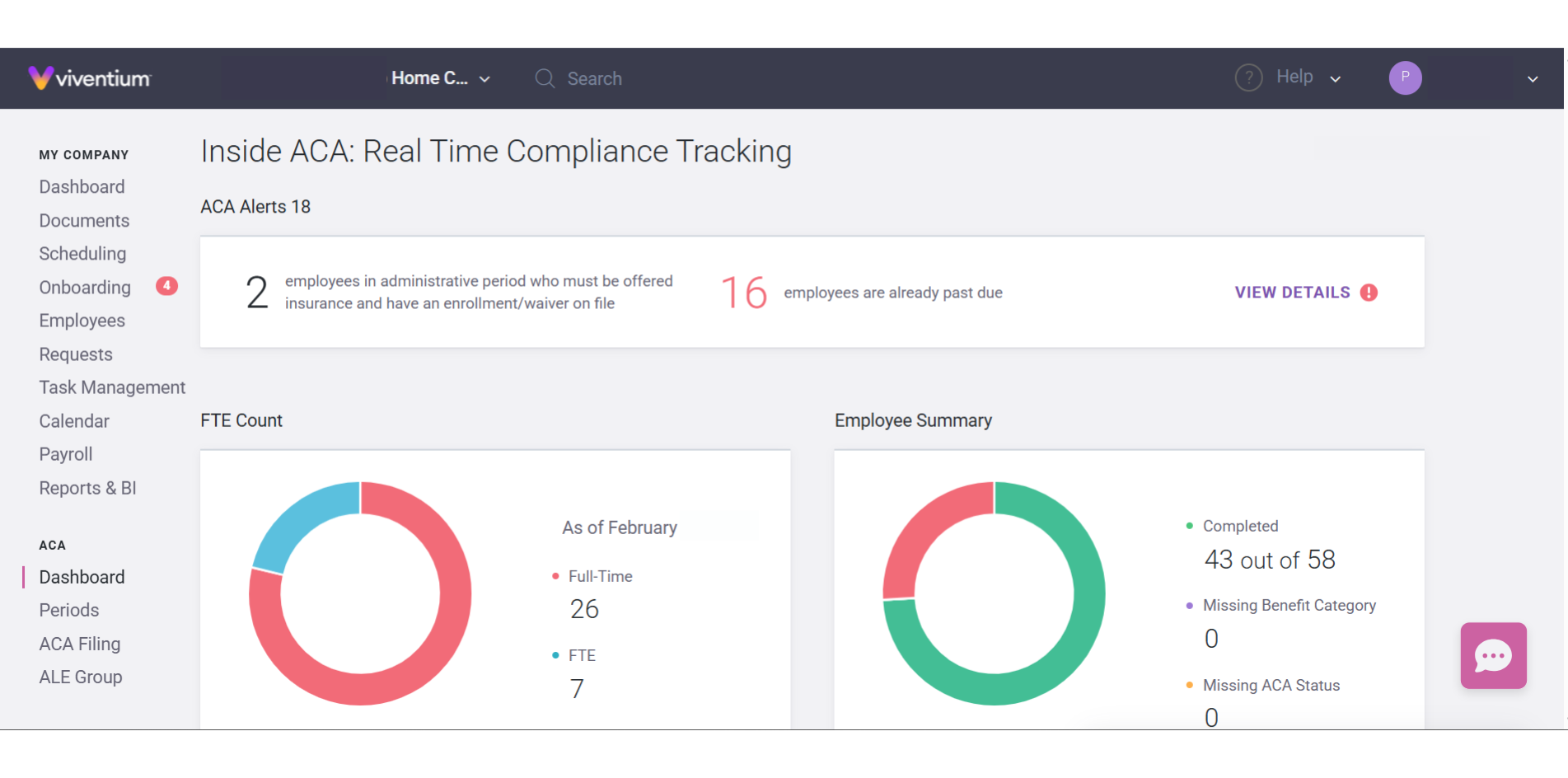

ACA compliance dashboard

Stay compliant by monitoring your ALE status and full-time equivalent (FTE) employee count on a user-friendly dashboard

Visualize compliance data

View your ACA data with a variety of graphical and numerical breakdowns to gain actionable insights

Real-time status updates

Get real-time updates on employees’ full-time and part-time status to ensure accurate reporting

Automatic status change list

Automatically generate a list of employees whose status changes to keep compliance tracking effortless

Amendments

Have a need for an amendment to your previously filed forms? Create, review and file that amendment all within Viventium.

Proven. Trusted. Preferred.

Solutions Tailored to Your Role Lorem

Administrators

Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra.

CEO

Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra.

Role/Persona

Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra.

Role/Persona

Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra.

"Viventium is a perfect blend of a great product and a great service. The software itself is extremely user-friendly, especially compared to other solutions we’ve tried, and the client service really stands out."

Simon Mord

Big Apple Homecare

Explore our entire product suite

Applicant Tracking

Onboarding

HR

Payroll

Benefits Administration

Scheduling

ACA Compliance

Business Intelligence

Learning Management

Expand your HR compliance expertise

Featured Resources

Guide

Skilled Nursing

Blog

Featured Resources

Skilled Nursing

Onboarding

Skilled Nursing

Based on 1,000+ reviews from