Calculators

Payroll Tools

Calculate your net or “take-home” pay here. Take-home pay is what is left over from your wages after withholdings for taxes and deductions for benefits have been taken out. Salaried employees can enter either their annual salary or earnings per pay period.

The Flat Bonus Calculator uses supplemental tax rates to calculate withholdings on special wage payments like bonuses. If your state does not have a special supplemental rate, you will be redirected to the aggregate bonus calculator. This is state-by-state compliant for those states who allow the aggregate method or percent method of bonus calculations.

This tool will take you step-by-step through the process of filling out a Form W-4. The Form W-4 determines how much of your pay is withheld to pay federal, and in some cases, state and local taxes. At the last step, you will even be able to print an official copy to give to the payroll department at your company.

The Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments, such as bonuses. This is state-by-state compliant for those states that allow the aggregate method or percent method of bonus calculations.

Here you can calculate take-home pay based on up to six different hourly pay rates that you enter. This is the perfect solution for those who are paid on a changing hourly basis.

The 401(k) calculator helps you plan for your future. Your 401(k) plan account might be your best tool for creating a secure retirement. Why? You only pay taxes on contributions and earnings when the money is withdrawn. Plus, many employers provide matching contributions. Use this calculator to see how increasing your contributions to a 401(k) can affect your paycheck and your retirement savings.

The Gross-up Calculator helps you determine the amount of gross wages before taxes and deductions are withheld, given a specific take-home pay amount.

Want to talk more about Payroll Calculations?

Explore our entire product suite

Applicant Tracking

Onboarding

HR

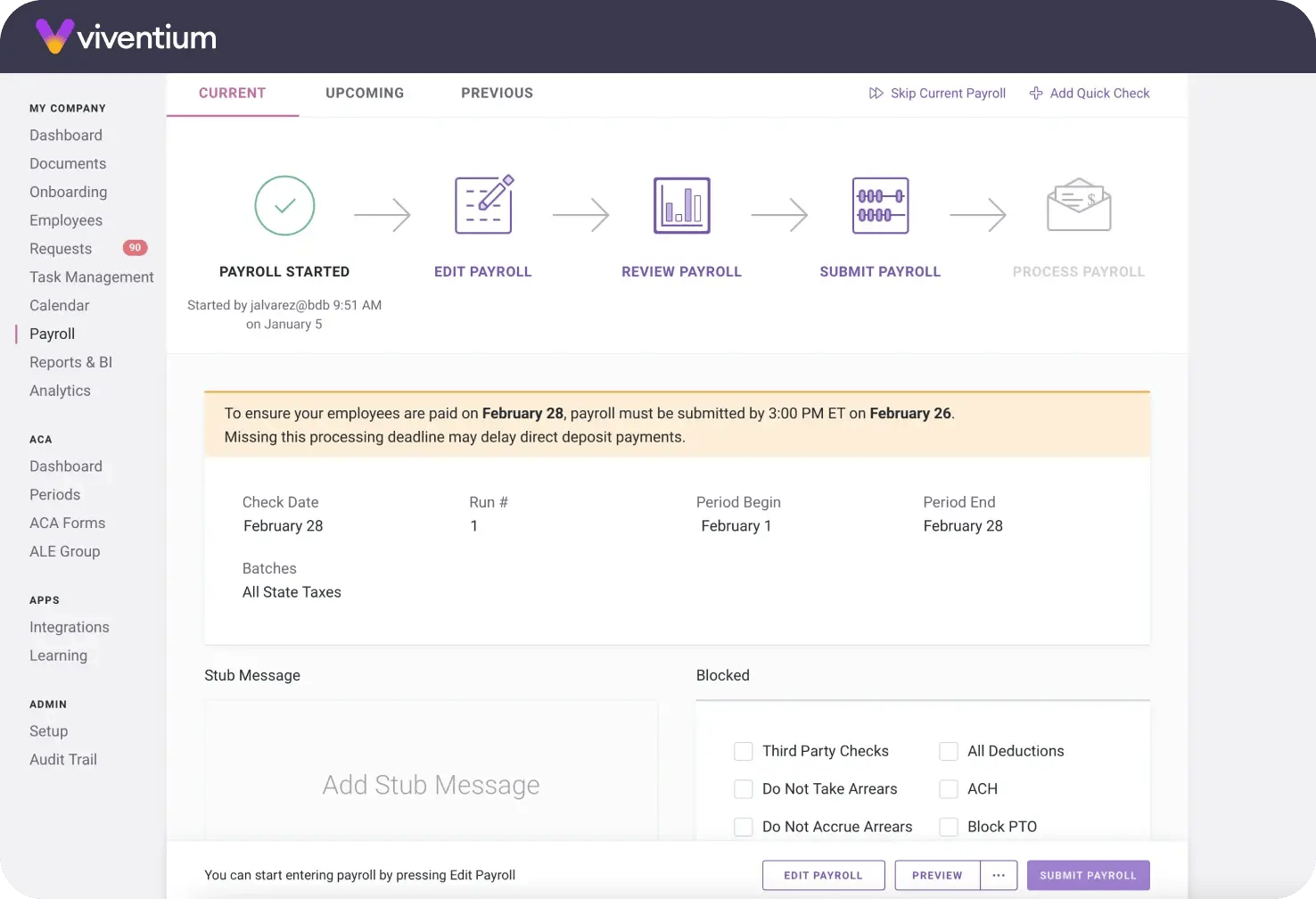

Payroll

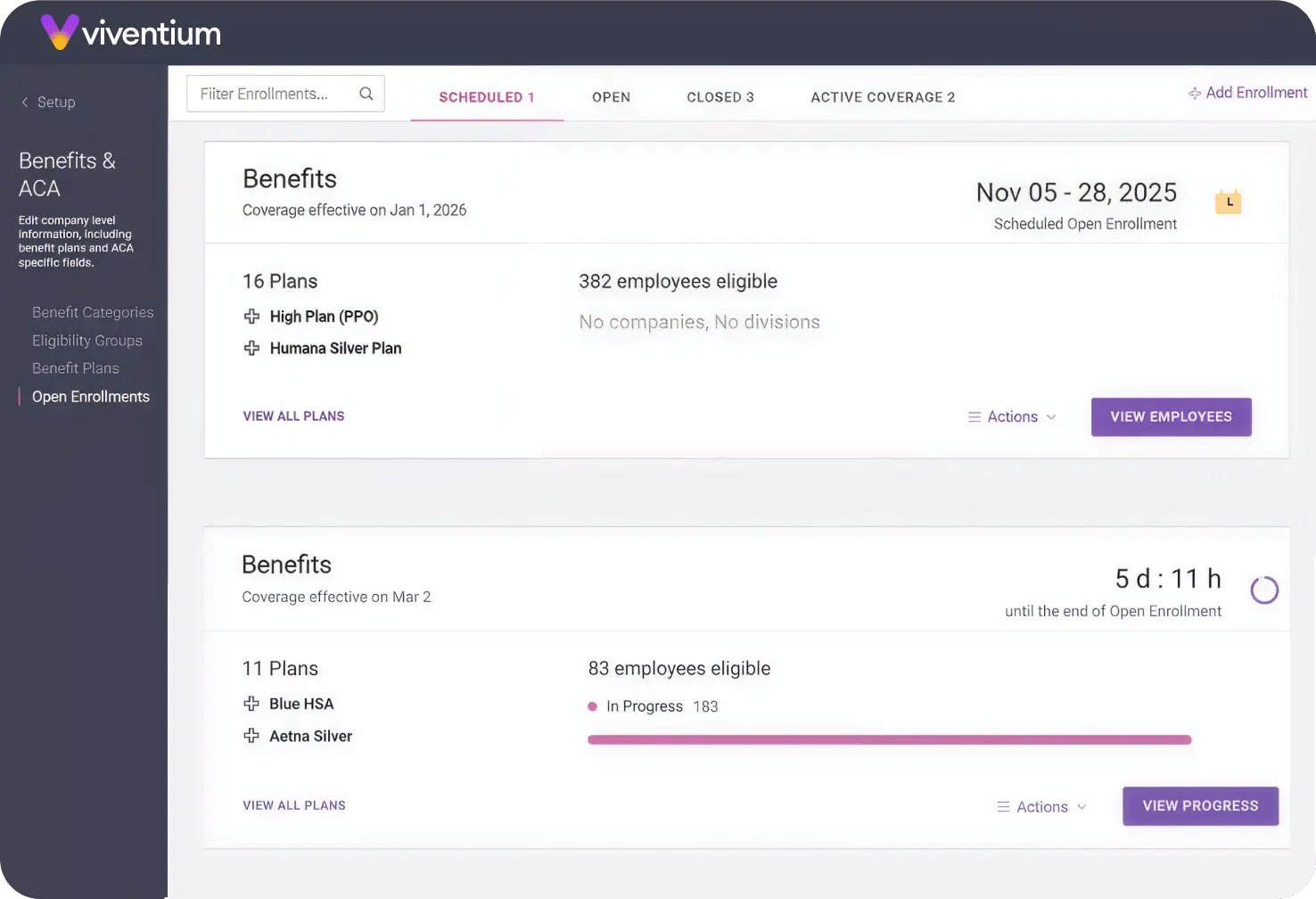

Benefits Administration

Scheduling

Time & Attendance

ACA Compliance

Business Intelligence

Learning Management

Ecosystem lorem ipsum sed torto

Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra porttitor est.

-

Duis aute - dolor in reprehenderit in volu occaecat veli esse chillum dolore eu fugiat.

-

Duis aute - dolor in reprehenderit in volu occaecat veli esse chillum dolore eu fugiat.

Benefits sed lorem ipsmu

Compliance CTA esque nullam cras

Assets Viventium Epau Dolor Dit

mattist

mattist

mattist

Customer Pull Quote Lorem

"Viventium Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus.pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus"

Issac Soussan

CFO Honor Health Network

"Viventium Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus.pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus"

Issac Soussan

CFO Honor Health Network

"Viventium Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus.pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus"

Issac Soussan

CFO Honor Health Network

Related Resources Eau Dolor Sit

.png?width=452&height=240&name=Image%20(55).png)

Type

Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus. Cras tortor vestibulum interdum risus.

.png?width=452&height=240&name=Image%20(55).png)

Type

Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus.

.png?width=452&height=240&name=Image%20(55).png)

Type

Lorem ipsum dolor sit amet consectetur. Vestibulum molestie donec neque pharetra sem porttitor est id pharetra. Cras tortor vestibulum interdum risus.

Product Suite Lorem Ipsum

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Onboarding

![Image [image_scale_anim]](https://viventium.com/hs-fs/hubfs/Image%20%5Bimage_scale_anim%5D.png?width=738&height=504&name=Image%20%5Bimage_scale_anim%5D.png)

Based on 1,000+ reviews from