Payroll and HR that knows healthcare

Designed specifically for healthcare providers, we take on complexity and compliance to uncomplicate your workday, everyday

End-to-end workforce management for healthcare

Hire, manage, and retain care staff with a fully integrated payroll, HR, and compliance solution that brings your operations and teams together.

Workforce management meets healthcare

A unified payroll, HR, and compliance platform designed to simplify operations for administrators and elevate support for your care team.

Trusted by over 3,000 providers

Is your HR & payroll system built for healthcare?

Software uniquely built for healthcare

Home-based care

Supporting home care teams with HR and payroll tools that work where they do.

Facility-based care

Simplifying payroll and HR within your facility with our solutions that are tailor-made for healthcare.

Other specialized care

Uncomplicate your business with a unified solution for payroll, HR, and compliance designed for healthcare providers.

The healthcare industry’s ally

for payroll, HR and compliance

Payroll accuracy with speed

Accurate, on-time payroll processing that simplifies your operations and reduces costs

All-in-one HR

Manage all HR functions from onboarding to compliance in the same place

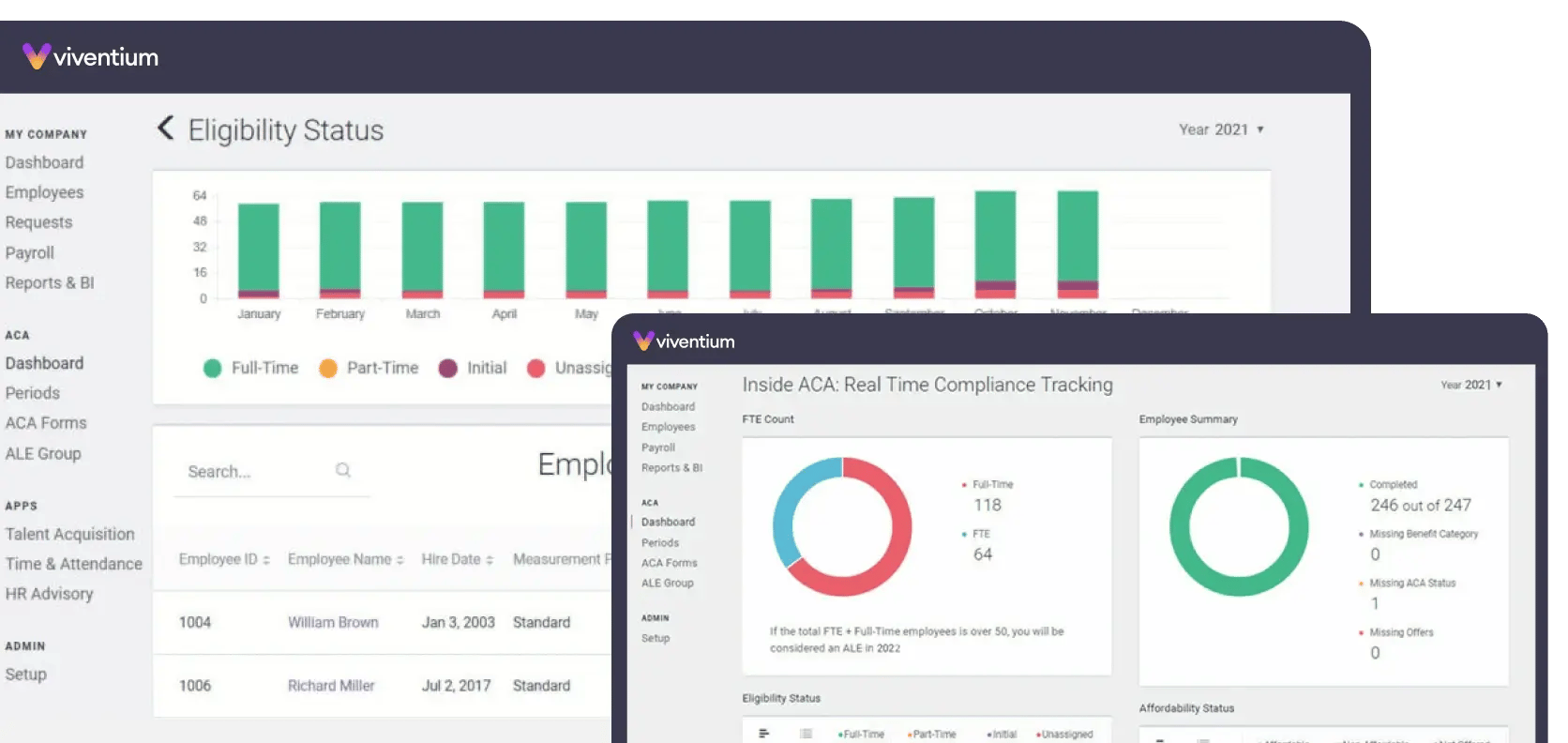

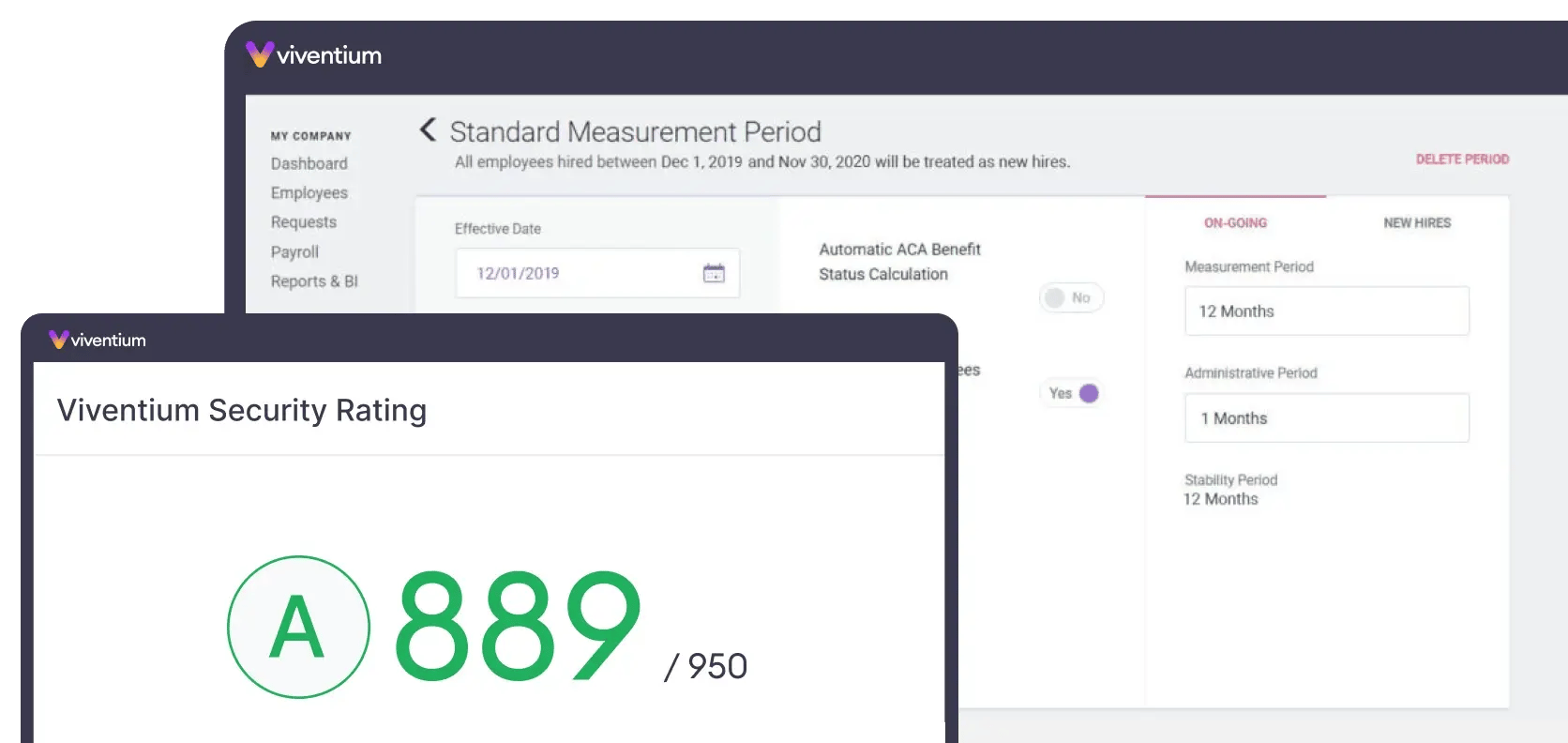

Healthcare compliance

Navigate complex regulations with confidence and ease

Better care staff experience

Connect care staff to their purpose and joy

Benefits

Reclaim your time, focus on care

Reduce administrative burdens and dedicate more time to what matters most

-

Hire quality caregivers quickly and easily

-

Boost staff engagement and retention effortlessly

-

Achieve peace of mind with compliance

-

Control costs and optimize staffing efficiently

-

Automate payroll and tax management with ease

Viventium in the News

ABA – Industry

Home Health

%20(1).png)

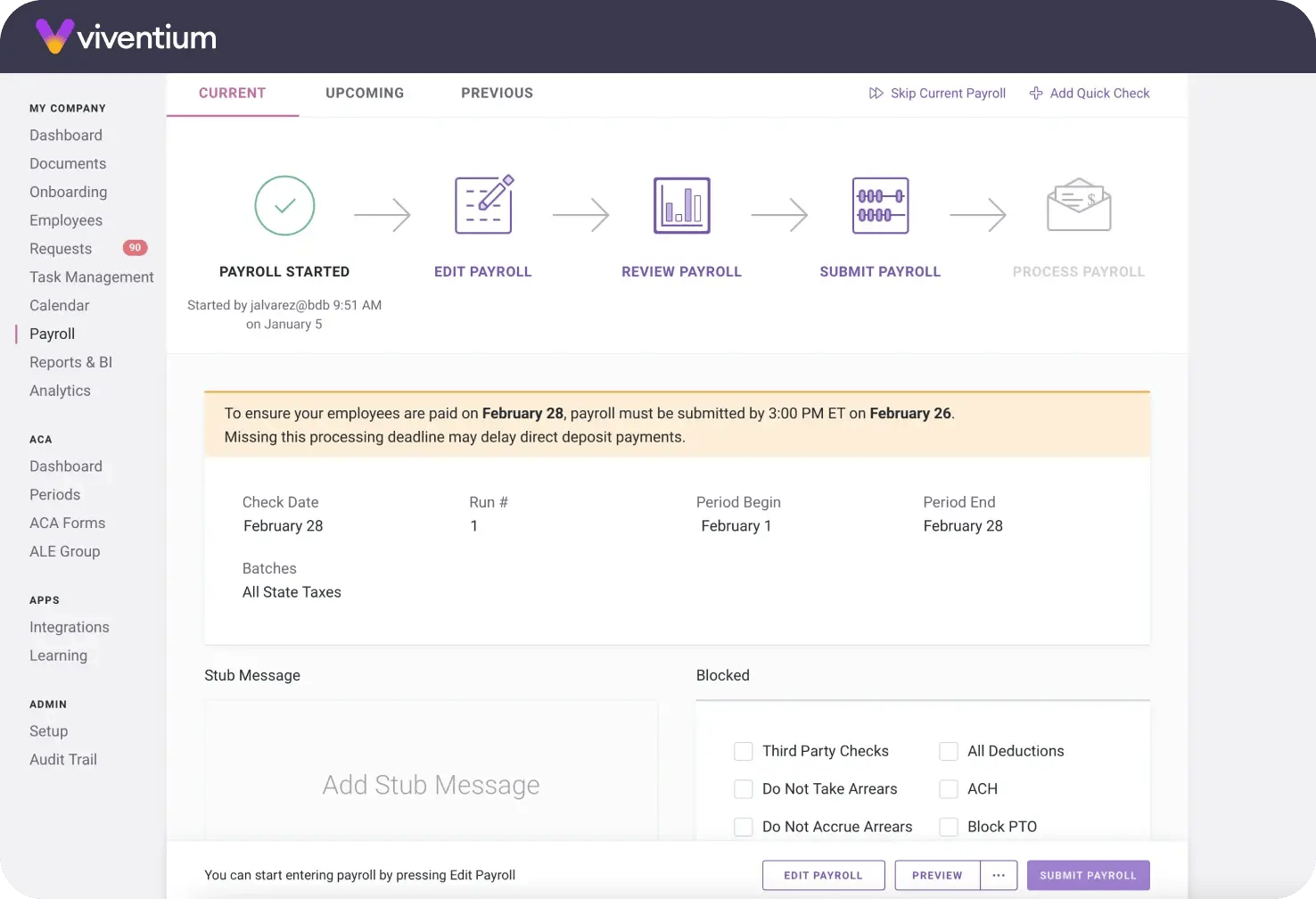

Payroll

"Viventium’s commitment to their clients has exceeded our expectations. The team from sales to client services provides excellent support, and we know when we have the occasional payroll emergency, we can count on the relationship we have built over the years. We are confident that Viventium will continue to help us maximize use of the software and provide a great partnership as we grow."

Issac Soussan

Honor Health Network

"Viventium is doing a fine job with the mechanics of the automation. It’s worked well, it’s been much easier. The fact that Viventium’s implementation folks actually spent time with me to ensure that the automation is working made a huge difference."

Stacy Lopis

Visiting Angels

"Viventium transformed my daily operations when onboarding new employees by reducing the time they spend in the office filling out paperwork. Now, everything can be completed before their initial training, keeping things organized and eliminating the need to rescan documents. It’s saved us a lot of administrative time on the back end. With onboarding running so smoothly, we're able to staff more quickly and serve more clients without getting bogged down in paperwork."

Wendy Raney

Homewatch CareGivers of North Dallas

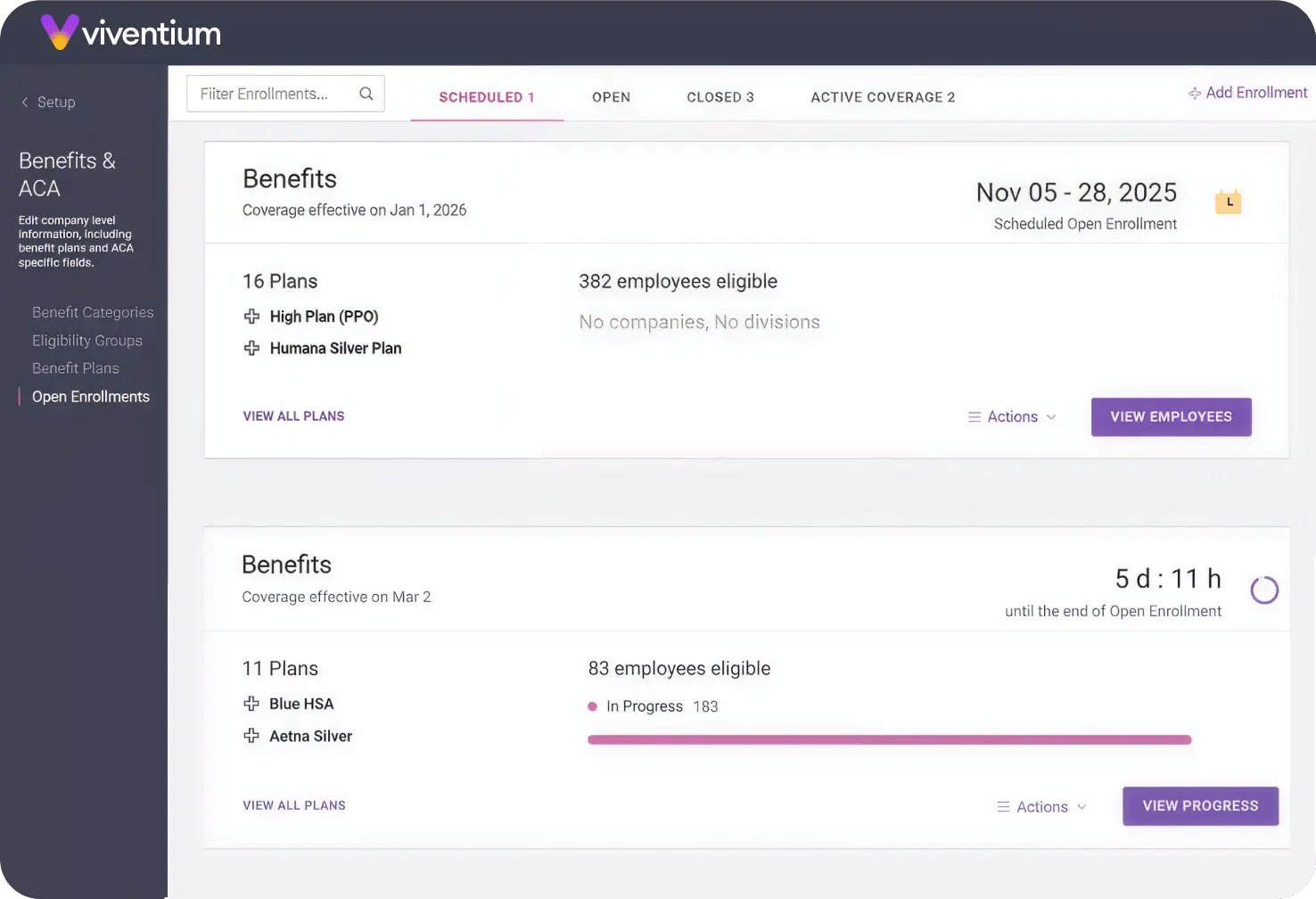

"The addition of Viventium’s Benefits Administration module to our product suite has been amazing. We were able to cut almost all of the manual work out of our open enrollment process, giving our HR team much-needed time back into their day."

United Living Community

Tailored for healthcare success

Purpose-built for healthcare

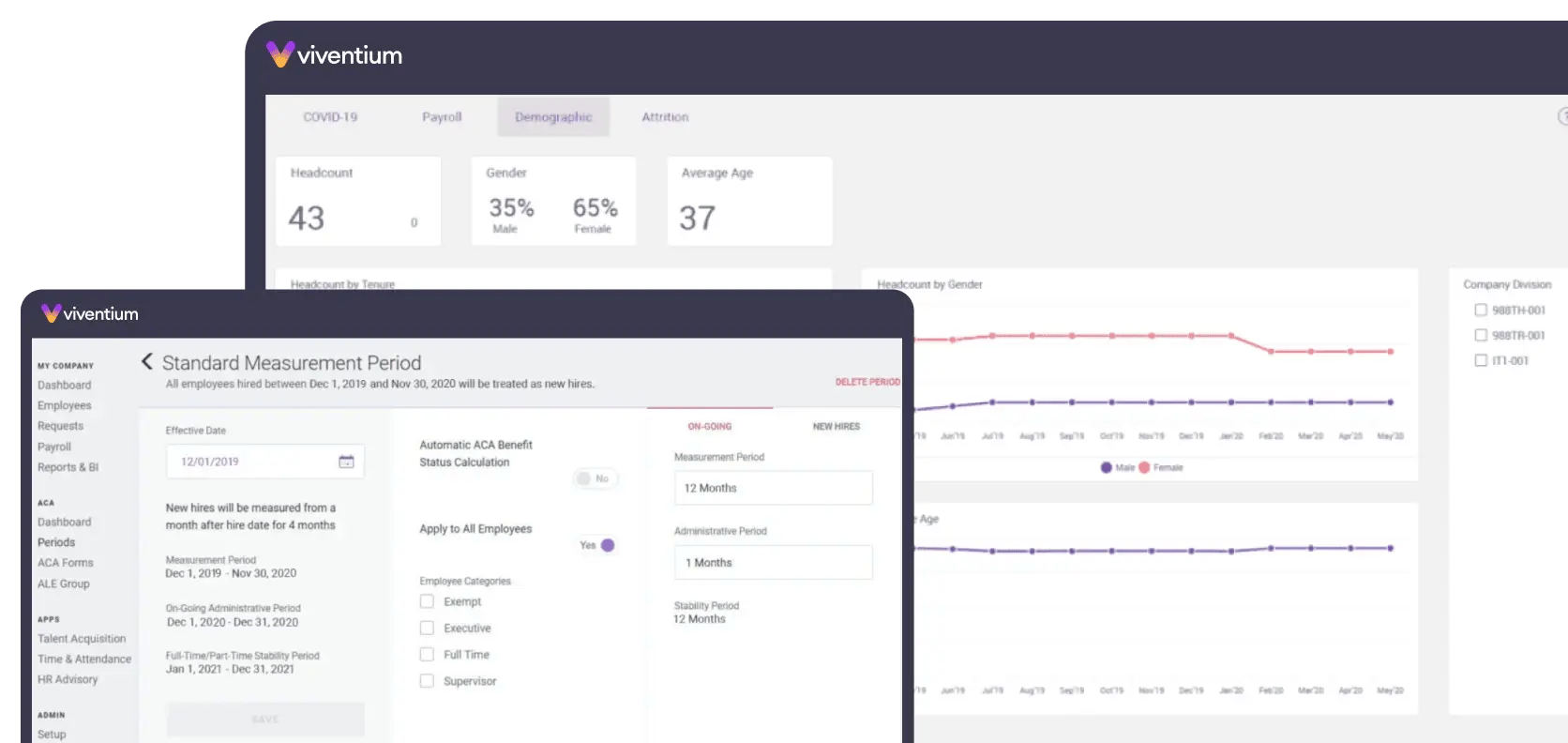

Tailored to meet the unique demands of healthcare, our solutions help you stay compliant, efficient, and connected. From CMS-compliant PBJ reporting to paperless onboarding, AMS/EHR integrations, license tracking, and on-demand pay, we provide the tools you need to support your workforce.

All-in-one platform

Simplify your operations with a unified system that connects payroll, HR, compliance, and more—all in one place. Stop juggling multiple tools or outdated processes. Uncomplicate your business with one powerful solution and gain the efficiency, accuracy, and control you need to manage your workforce with confidence.

Dedicated support & industry expertise

Our team doesn’t just support healthcare—we live and breathe it. With deep industry knowledge, we understand your compliance requirements, reimbursement challenges, and workforce needs. Plus, our experts speak your language, ensuring you get personalized support and solutions that truly work for your organization.

Explore our entire product suite

Applicant Tracking

Onboarding

HR

Payroll

Benefits Administration

Scheduling

ACA Compliance

Business Intelligence

Learning Management

Simply Brilliant

500K+

90%+

70+

Proven. Trusted. Preferred.

500K+

healthcare staff paid

90%+

for client retention

70+

NPS

Our Partner Ecosystem

We’re stronger together. We partner with other industry leaders to extend our capabilities and deliver the best possible experience for our clients.

Product Partners

We team up with top product partners to deliver the best solutions for agencies, facilities, and communities.

AMS/EMR Partners

Our AMS/EMR partners combined with the Viventium suite will help you elevate your healthcare organization.

Franchise Partners

We work closely with our many franchise partners to provide an exceptional HR experience.

Based on 1,000+ reviews from